ESG performance

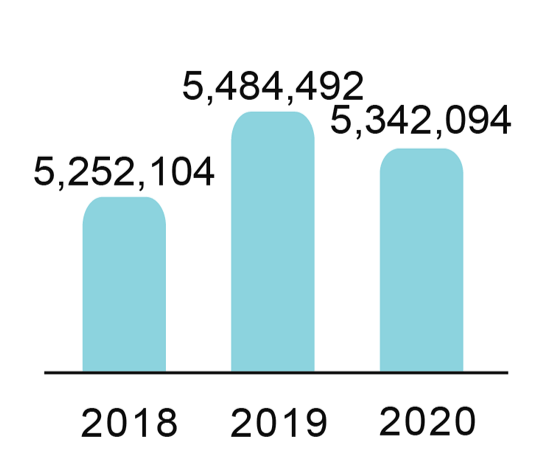

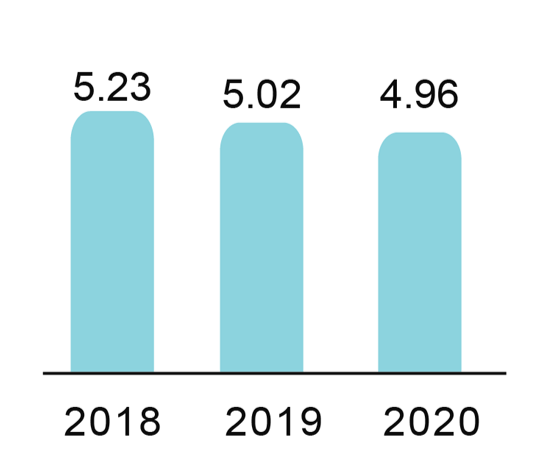

The corporate business performance is mainly based on its profitability, asset management, financial solvency and overall development ability. An-Shin's consolidated revenue remained at NT$5.3 billion in 2020 despite of the impact the COVID-19 and we make sure to take sustainability as a part of our business. With the great efforts of every em-ployee, we successfully gained consumer trust and confidence and returned our investor with earnings per share (EPS) NT$ 4.96, return on equity (ROE) 8.57% and return on assets (ROA) 3.86%.

Governance/Economic

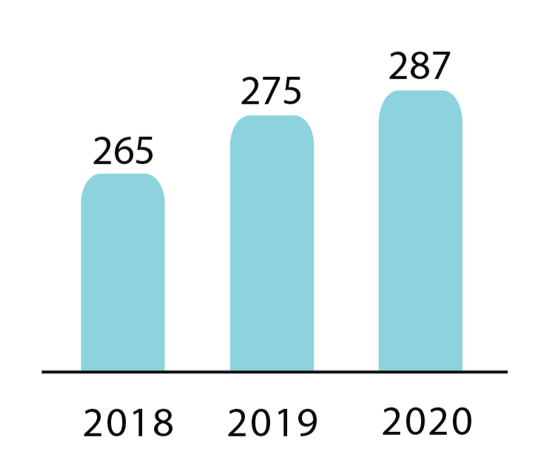

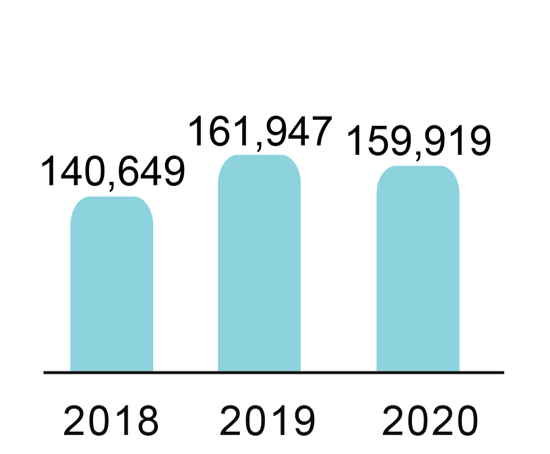

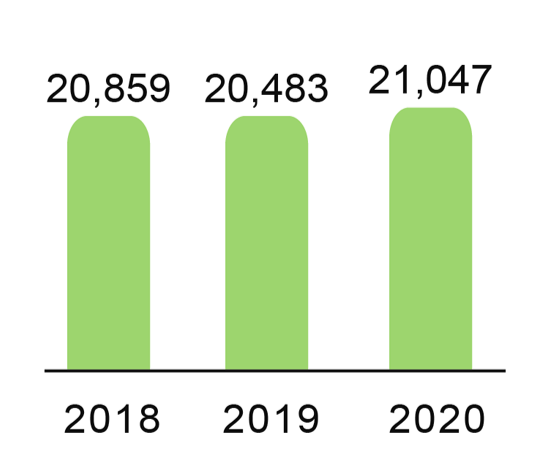

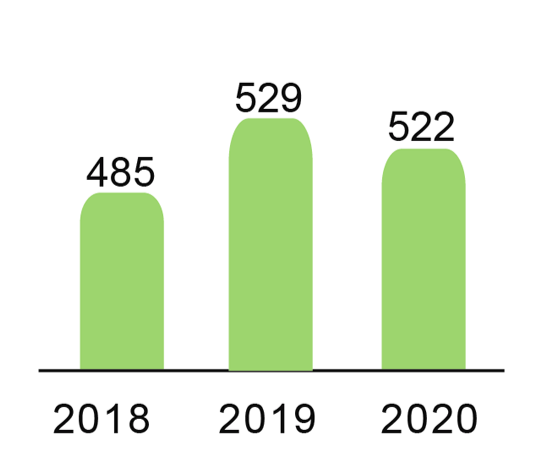

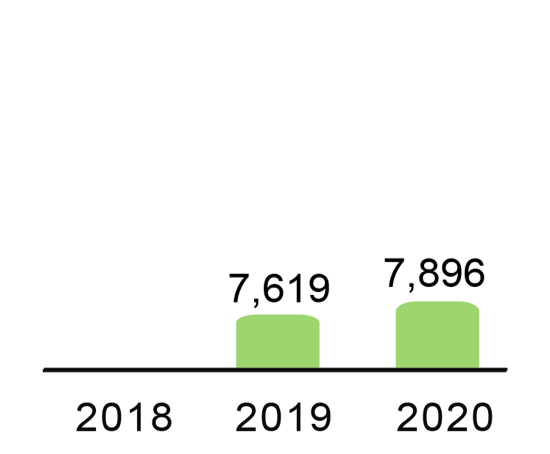

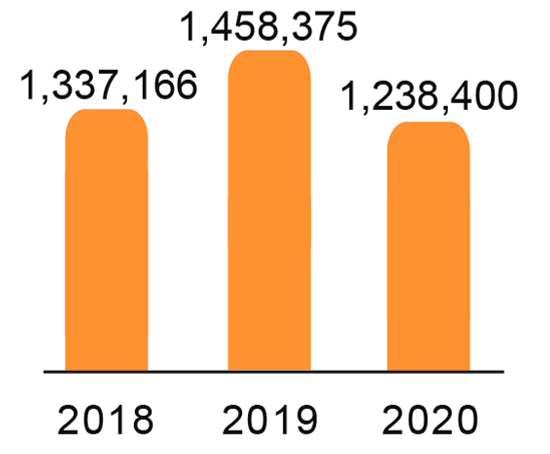

Total Stores

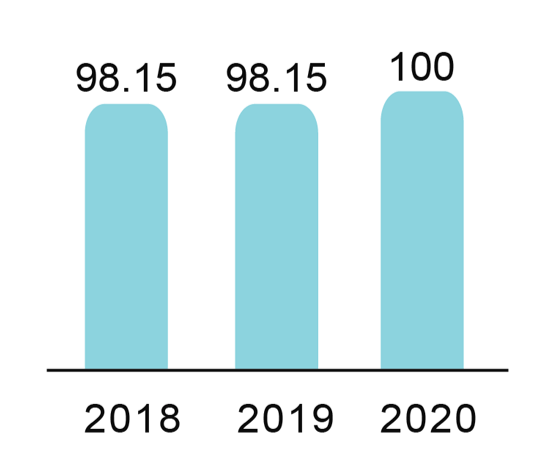

Attendance rate of BOD

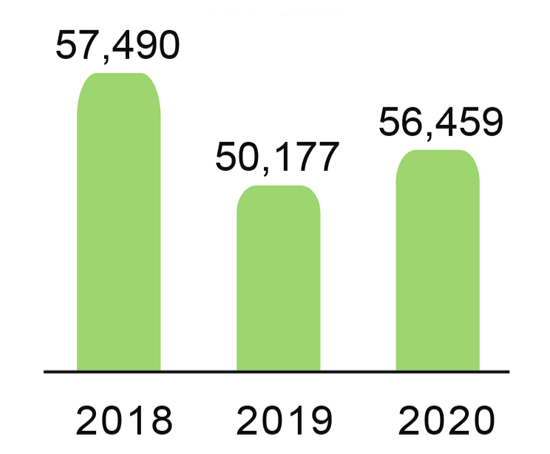

Consolidated Sales

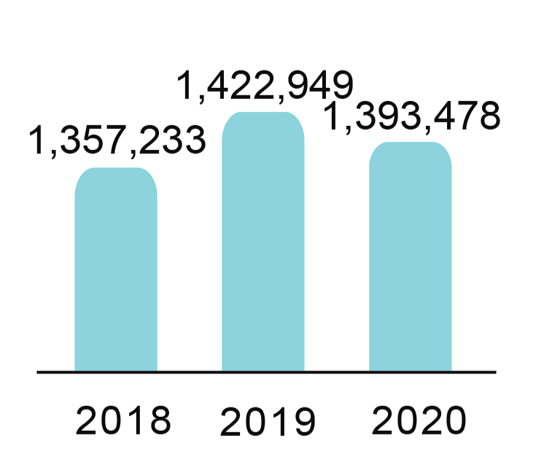

Consolidated Sales Gross Profit

Consolidated Net Income

EPS

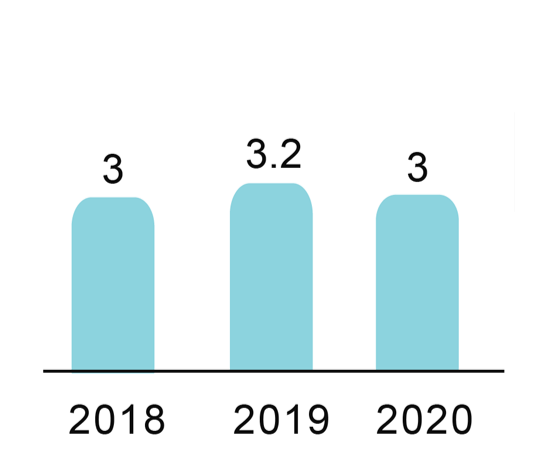

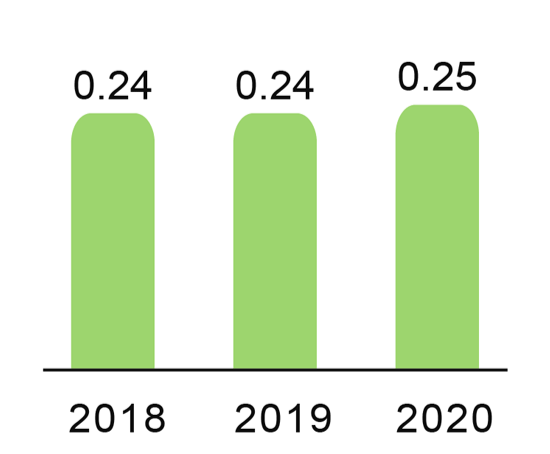

Cash Dividend Per Share

New Product Items

Environmental

Electricity Intensity

Water Use Intensity

Category 2 Greenhouse Gas Emissions

Recycleable Waste

Non-reuseable Oil

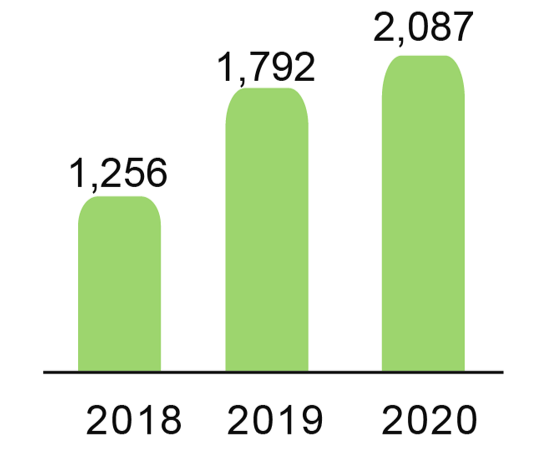

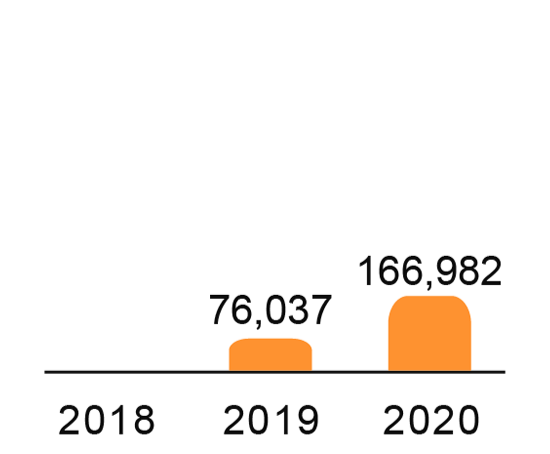

Investment in Environmental Protection & Energy Savings

TAP Certified Purchase

TAP Certified Vegetables Purchase

PEFC Certified Purchase(NT$ thousands)

FSC Certified Purchase

Social

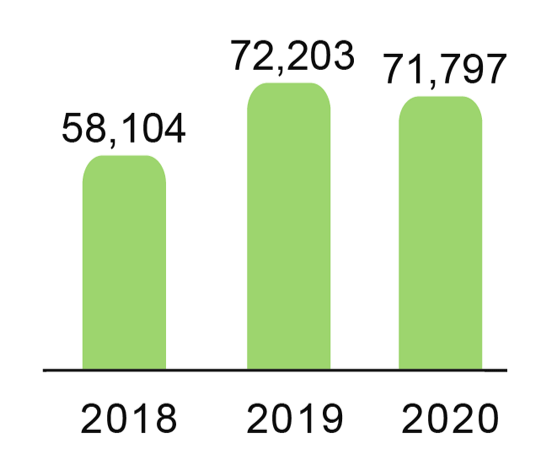

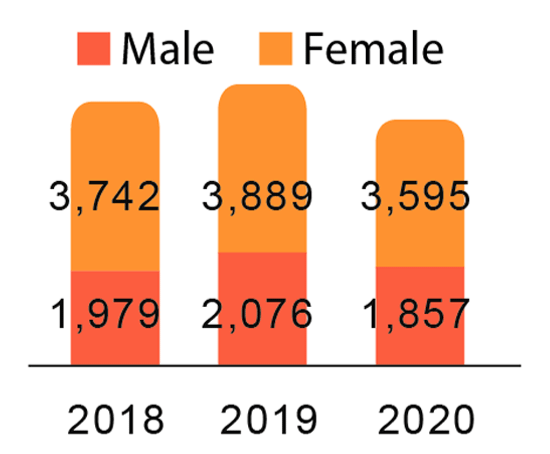

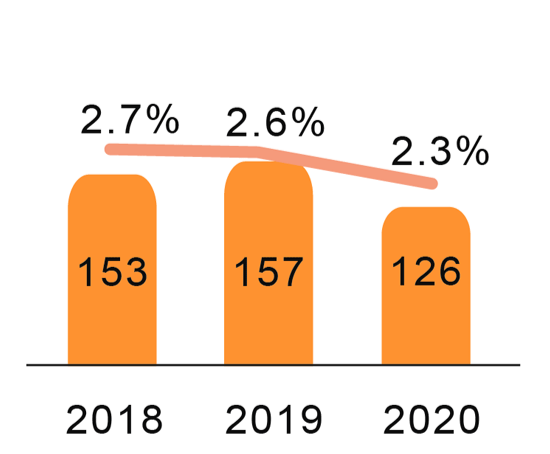

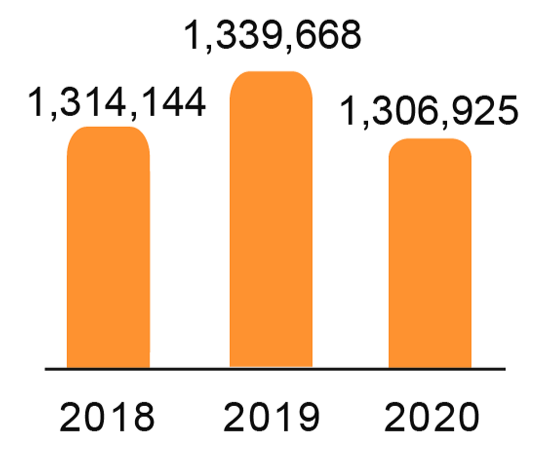

Employees

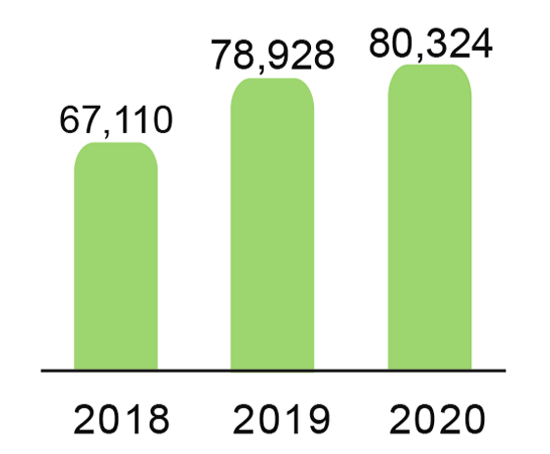

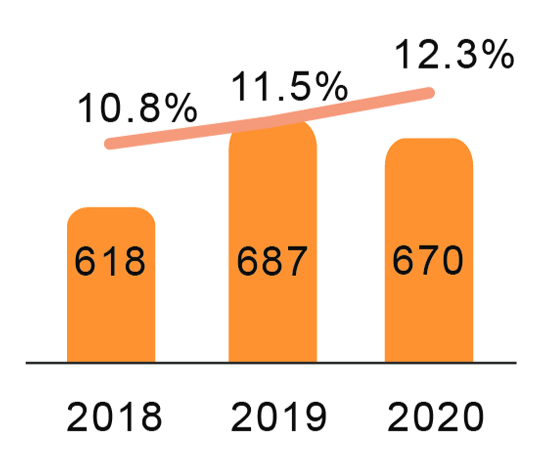

Middle-aged Employees

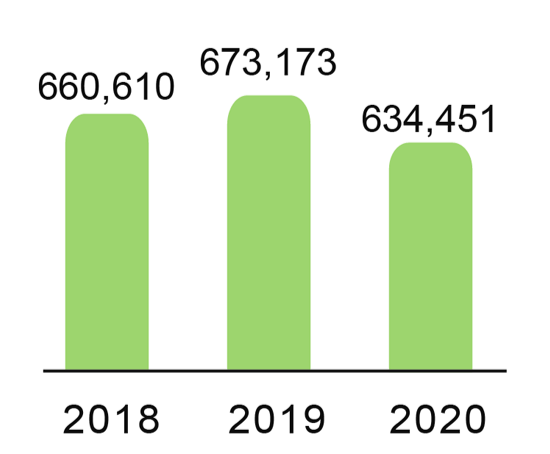

Disabled Employees

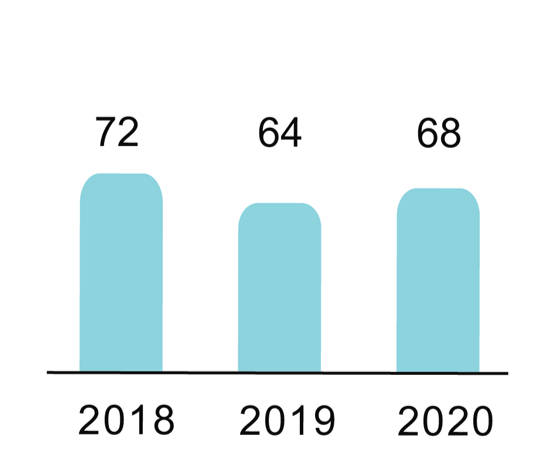

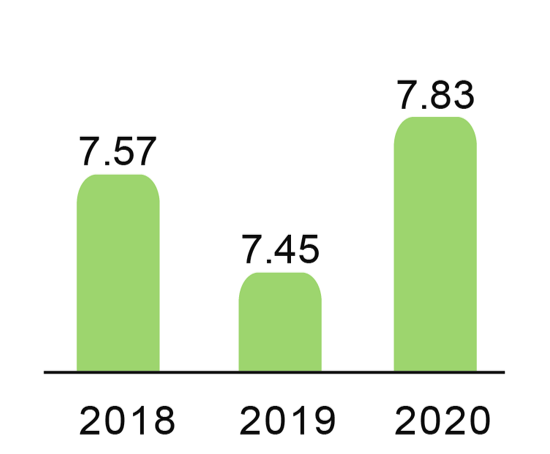

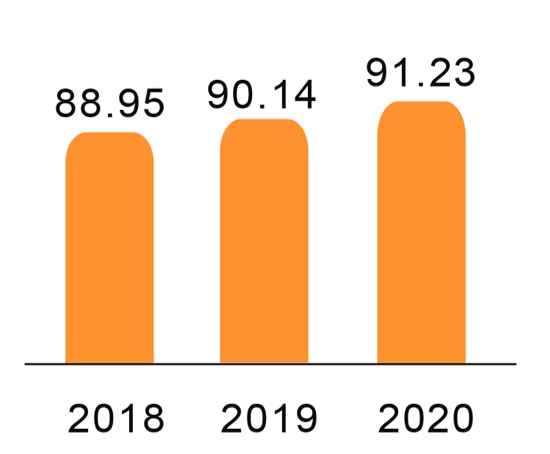

Covert Customer Audit Scores

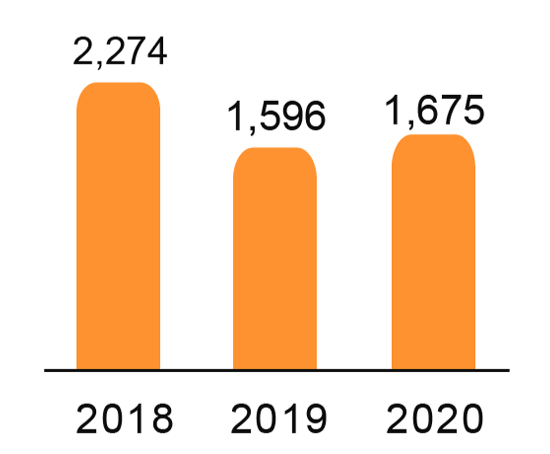

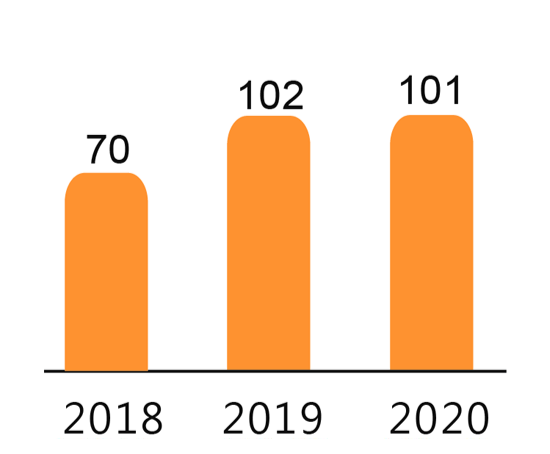

# of Stable Suppliers

FSSC 22000 Certified Purchase

ISO 22000 Certified Purchase

(NT$ thousands)

HACCP Certified Purchase

(NT$ thousands)

3rd-Party Inspection expense