- Sustainability

- Brand Story - NEW

- News and Events

- Message from our Chairman - NEW

- SDGs Action Plans - NEW

- ESG performance - NEW

- ESG Committee - NEW

- Awards and Recognition - NEW

- Organizational Structure - NEW

- Sustainable Business Model - NEW

- Sustainable Business Strategy - NEW

- Stakeholders' Communication - NEW

- Identification of Material Topics - NEW

- Downloads

- Corporate Governance

- Food Safety

- Food Safety Management System -NEW

- Certified Laboratory-NEW

- Traceability Management

- Supplier Evaluation System-NEW

- Sustainable supply chain management-NEW

- Store sanitation sampting inspection mechanism-NEW

- Annual Representative Innovative Products-NEW

- Customer Feedback Management-NEW

- Store HDCS visit mechanism-NEW

- Environmental Sustainability

- Respectful Workplace

- Community Engagement

- Stakeholder Questionnaire

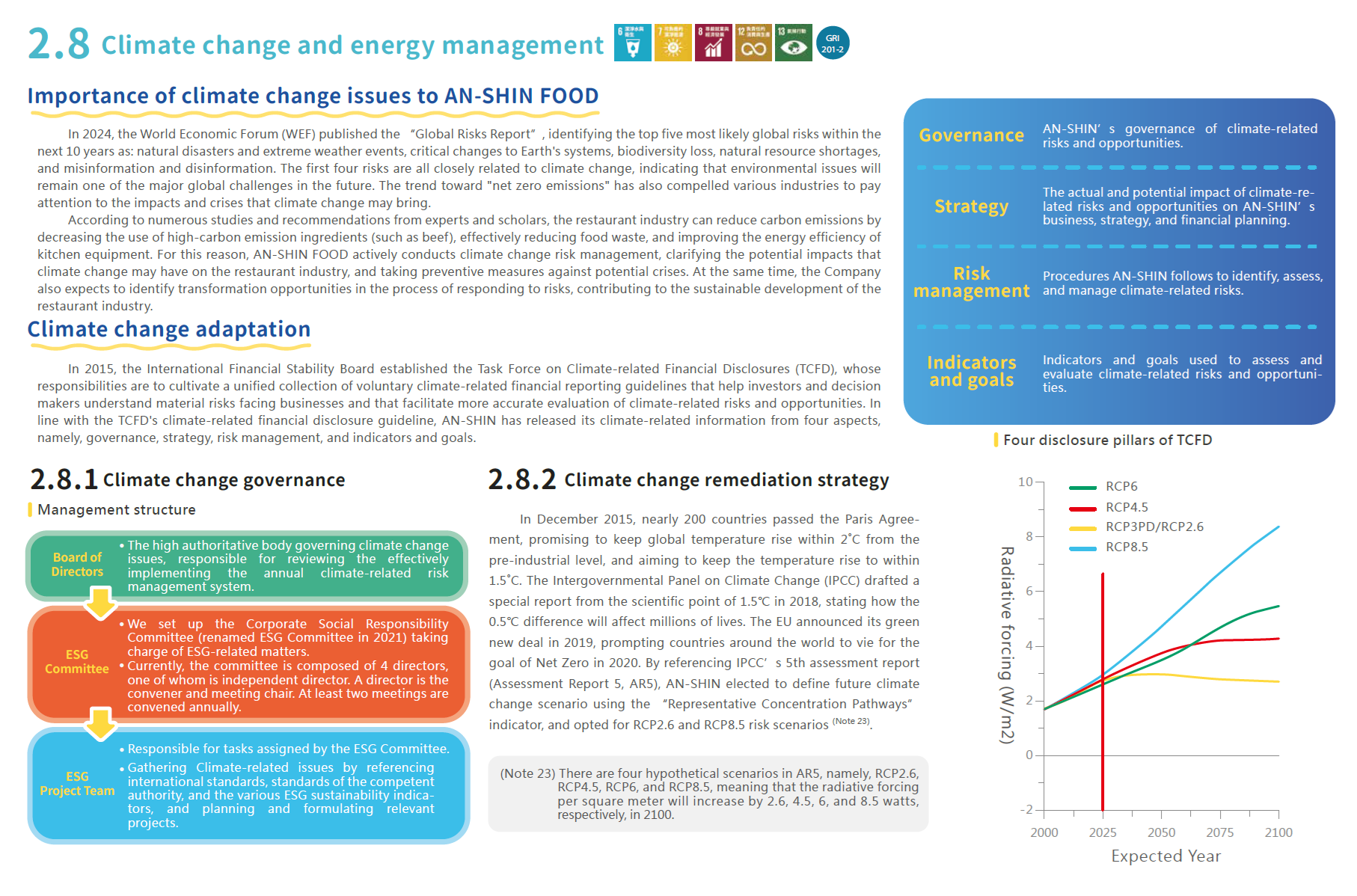

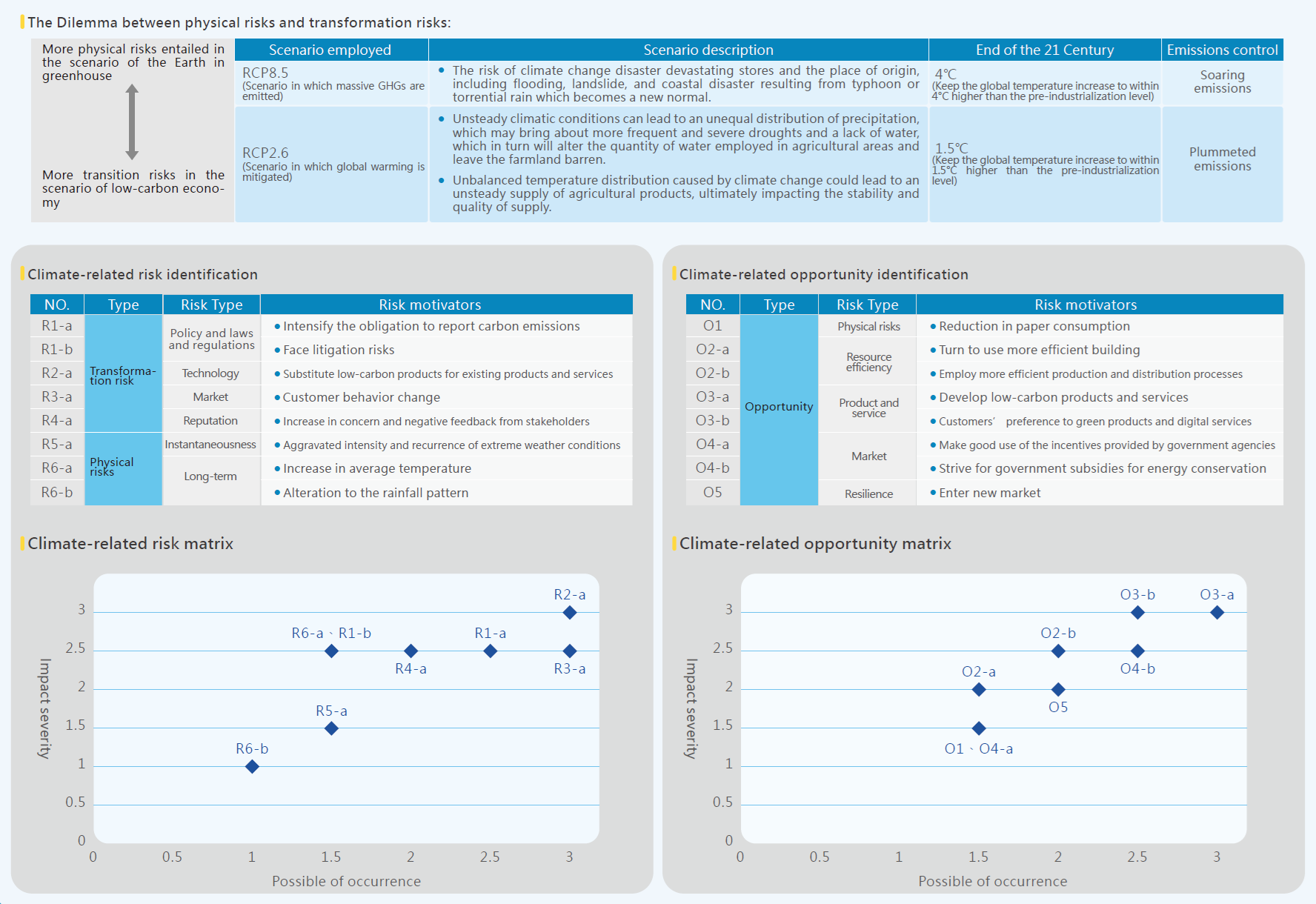

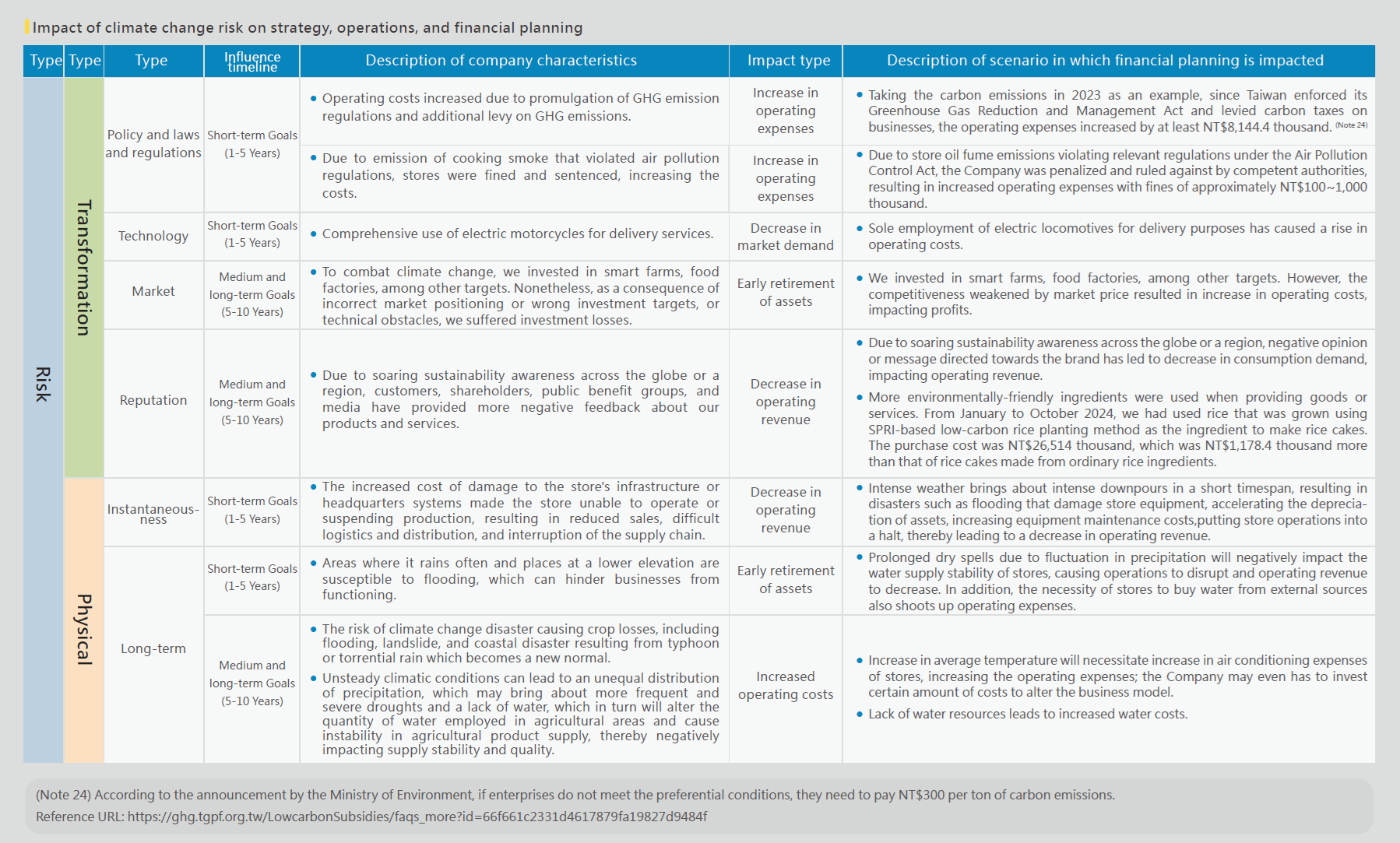

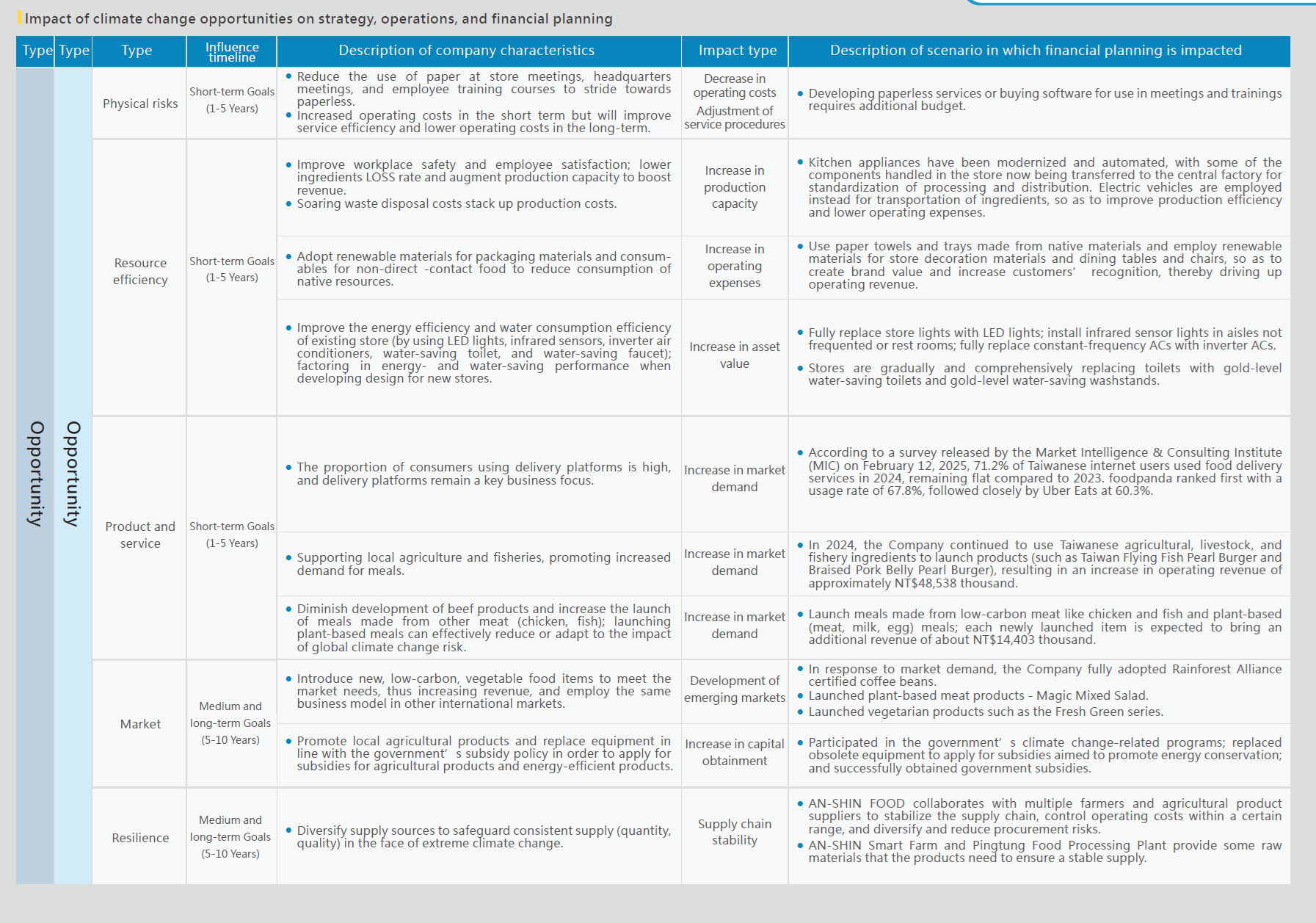

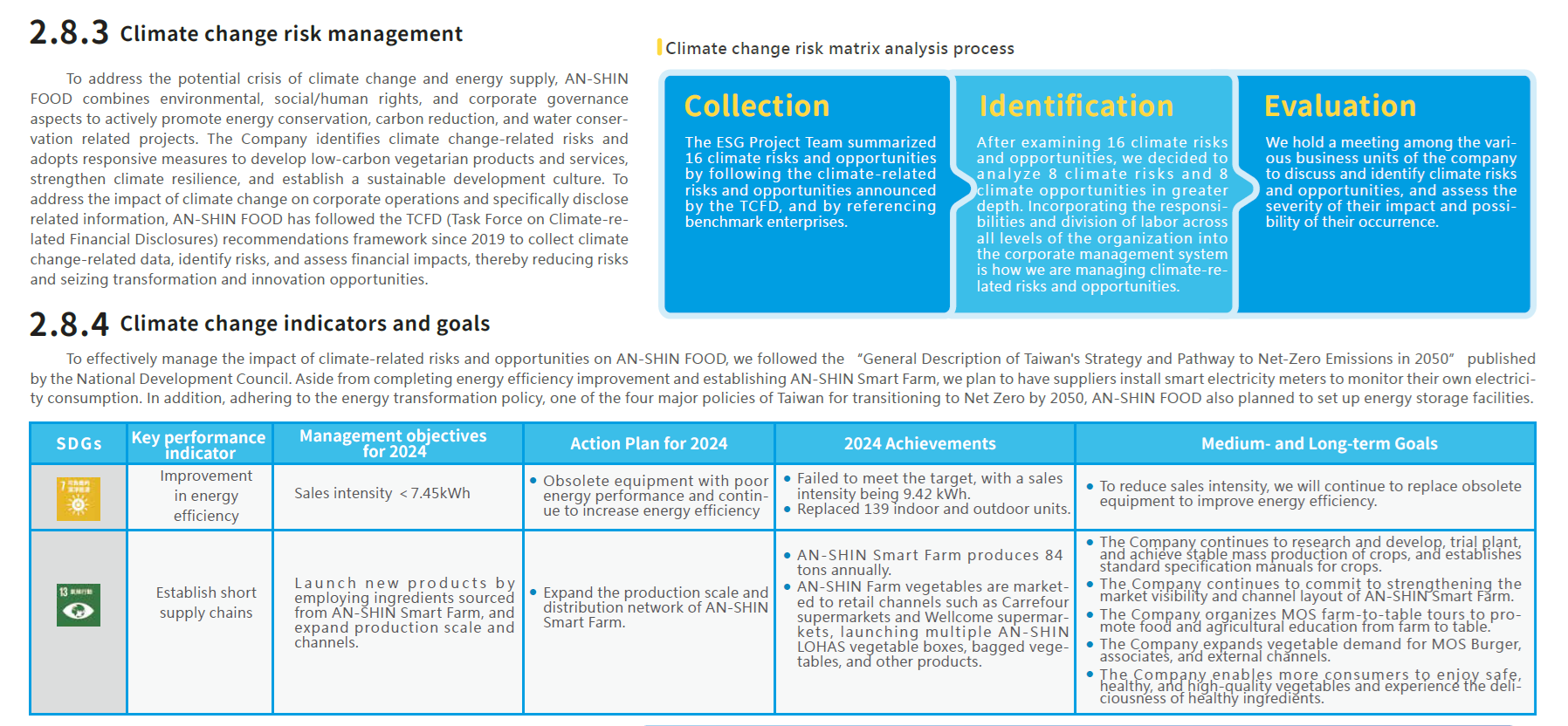

Environmental Sustainability

Protect and maintain the environmental resources for future generations.

Environmental Sustainability

Protect and maintain the environmental resources for future generations.

Environmental Sustainability

Protect and maintain the environmental resources for future generations.

Environmental Sustainability

Protect and maintain the environmental resources for future generations.